SAUCE Token

SAUCE is the native token of the SaucerSwap Protocol, created and managed through the Hedera Token Service (HTS).- Token ID: 0.0.731861

- EVM Address: 0x00000000000000000000000000000000000b2ad5

SAUCE Tokenomics

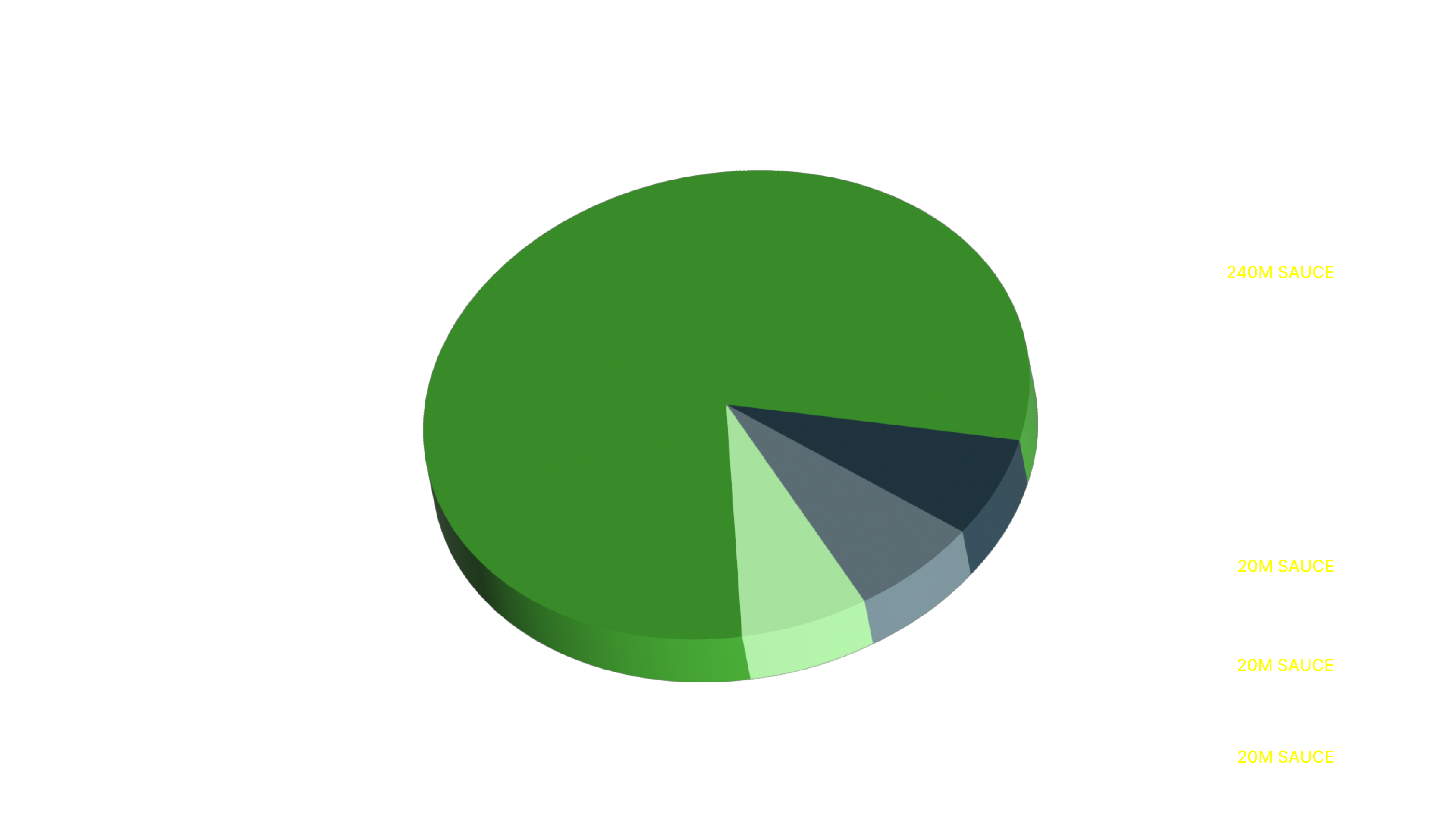

SAUCE has a maximum supply of 1 billion tokens. At genesis, 500 million SAUCE tokens were minted. Of these, 300 million were locked in non-upgradable vesting contracts owned by the SaucerSwap DAO, while 200 million entered circulation. The Masterchef contract is responsible for minting and distributing the remaining 500 million SAUCE tokens in accordance with a predefined release schedule.Initial Supply

A total of 200 million SAUCE tokens were initially released. Tokens in the Liquidity, Marketing, and Operations categories fell under DAO ownership, while those in the Community category were distributed to 729 eligible community members.- Liquidity: 2% of the max supply (20 million SAUCE) were converted to SAUCE/HBAR LP tokens, which were subsequently locked for a one-year period.

- Community: 14% of the max supply (140 million SAUCE) was distributed to community members holding Planck Epoch Collectible (PEC) NFTs based on the type and number of NFTs in their account.

- 1 Gravity PEC → 3,000 SAUCE

- 1 Weak Nuclear PEC → 14,000 SAUCE

- 1 Strong Nuclear PEC → 30,000 SAUCE

- 1 Electromagnetic PEC → 5,000 SAUCE

- Marketing: 2% of the max supply (20 million SAUCE) were sent to a DAO-controlled marketing multi-sig.

- Operations: 2% of the max supply (20 million SAUCE) were sent to a DAO-controlled operations multi-sig.

| Category | Number of Tokens | % of Initial Supply | % of Max Supply |

|---|---|---|---|

| Liquidity | 20.0 million | 10.00% | 2.00% |

| Community | 140.0 million | 70.00% | 14.00% |

| Marketing | 20.0 million | 10.00% | 2.00% |

| Operations | 20.0 million | 10.00% | 2.00% |

| Total | 200.0 million | 100.00% | 20.00% |

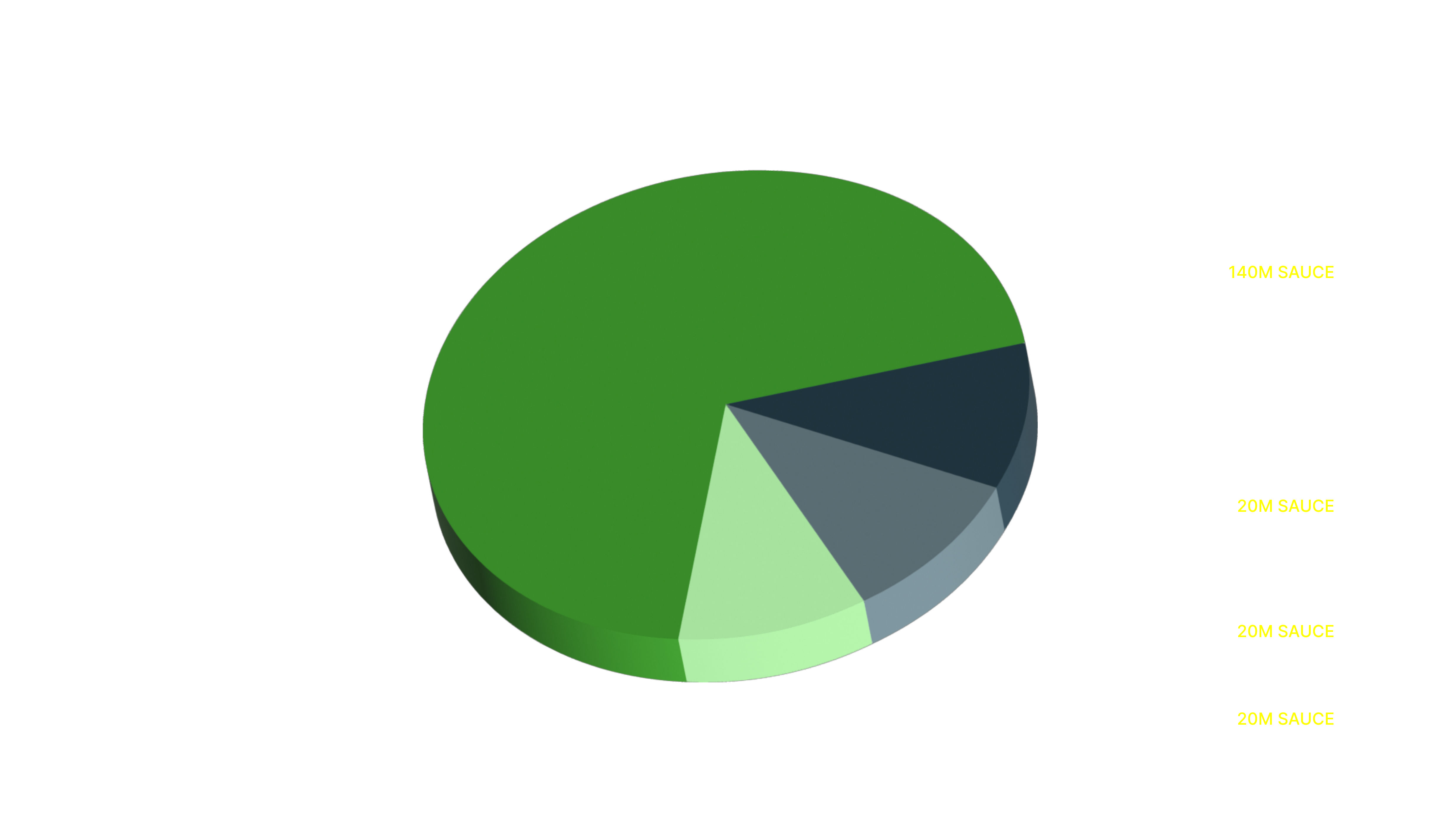

Vesting Allocations

At genesis, the DAO deployed a set of non-upgradeable vesting contracts where 300 million SAUCE was locked. Over a span of 3 years starting from genesis, these tokens undergo a linear vesting process.- Core Development: 24% of max supply (240 million SAUCE) vested from 0.0.1059453 to SaucerSwap Labs.

- Marketing: 2% of max supply (20 million SAUCE) vested from 0.0.1059333 to a DAO-controlled marketing multi-sig.

- Operations: 2% of max supply (20 million SAUCE) vested from 0.0.1059313 to a DAO-controlled operations multi-sig.

- Advisor: 2% of max supply (20 million SAUCE) vested from 0.0.1059259 to a DAO-controlled advisor multi-sig.

| Category | Number of Tokens | % of Vested Supply | % of Max Supply | Vesting Rate (SAUCE / min) |

|---|---|---|---|---|

| Core Development | 240.0 million | 80.00% | 24.00% | 152.21 |

| Marketing | 20.0 million | 6.67% | 2.00% | 12.68 |

| Operations | 20.0 million | 6.67% | 2.00% | 12.68 |

| Advisor | 20.0 million | 6.66% | 2.00% | 12.68 |

| Total | 300.0 million | 100.00% | 30.00% | 190.25 |

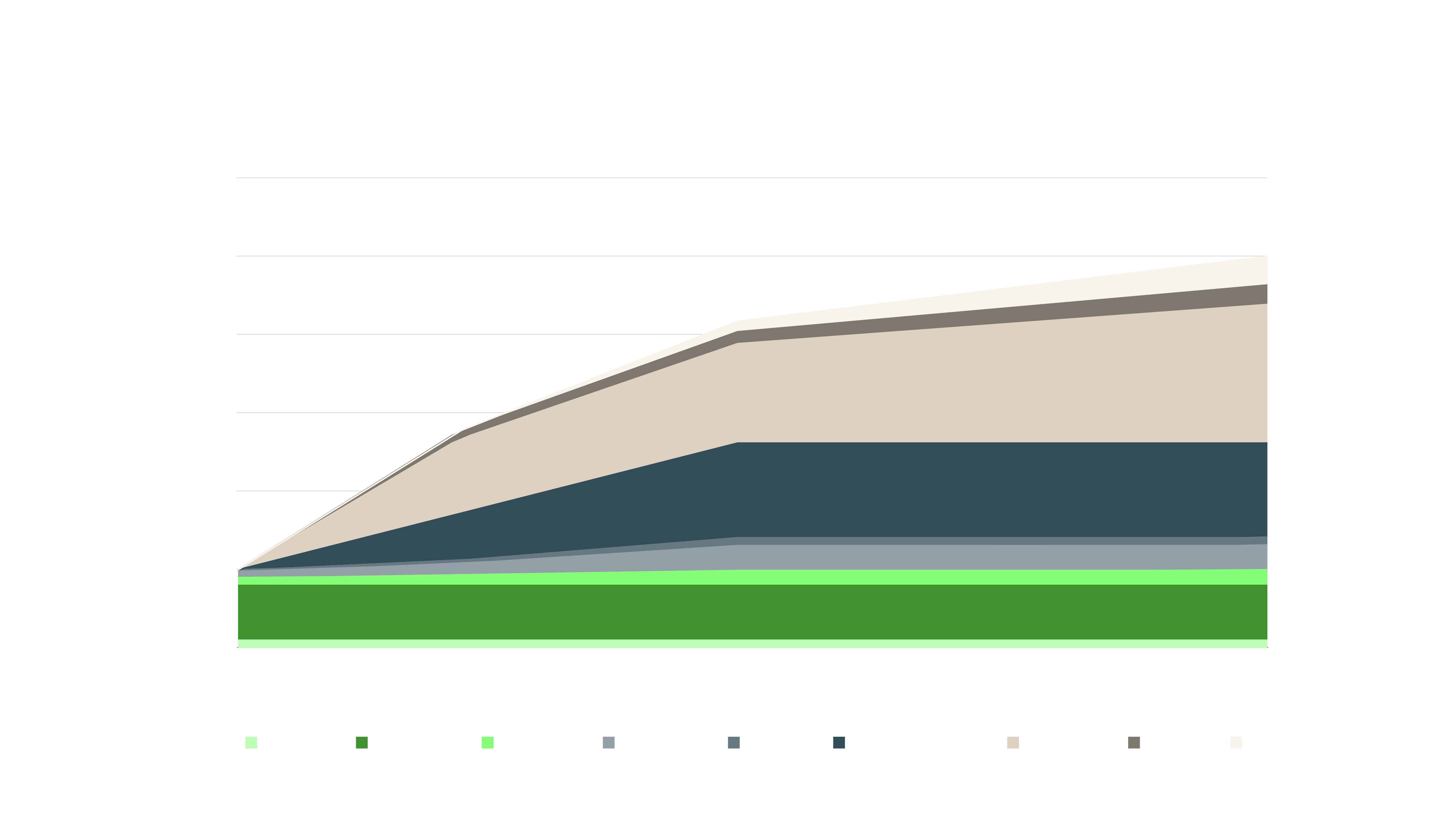

Masterchef Emissions

Central to the SaucerSwap protocol, the Masterchef smart contract acts as both the treasury account and the supply key for SAUCE, overseeing the minting and distribution of the remaining 500 million SAUCE. Note that, on August 8, 2023, the SaucerSwap DAO approved the Tokenomics V2 Proposal. This section will provide details about the updated tokenomics. For historical reference, you can access the archived Old Tokenomics documentation.Distribution Breakdown

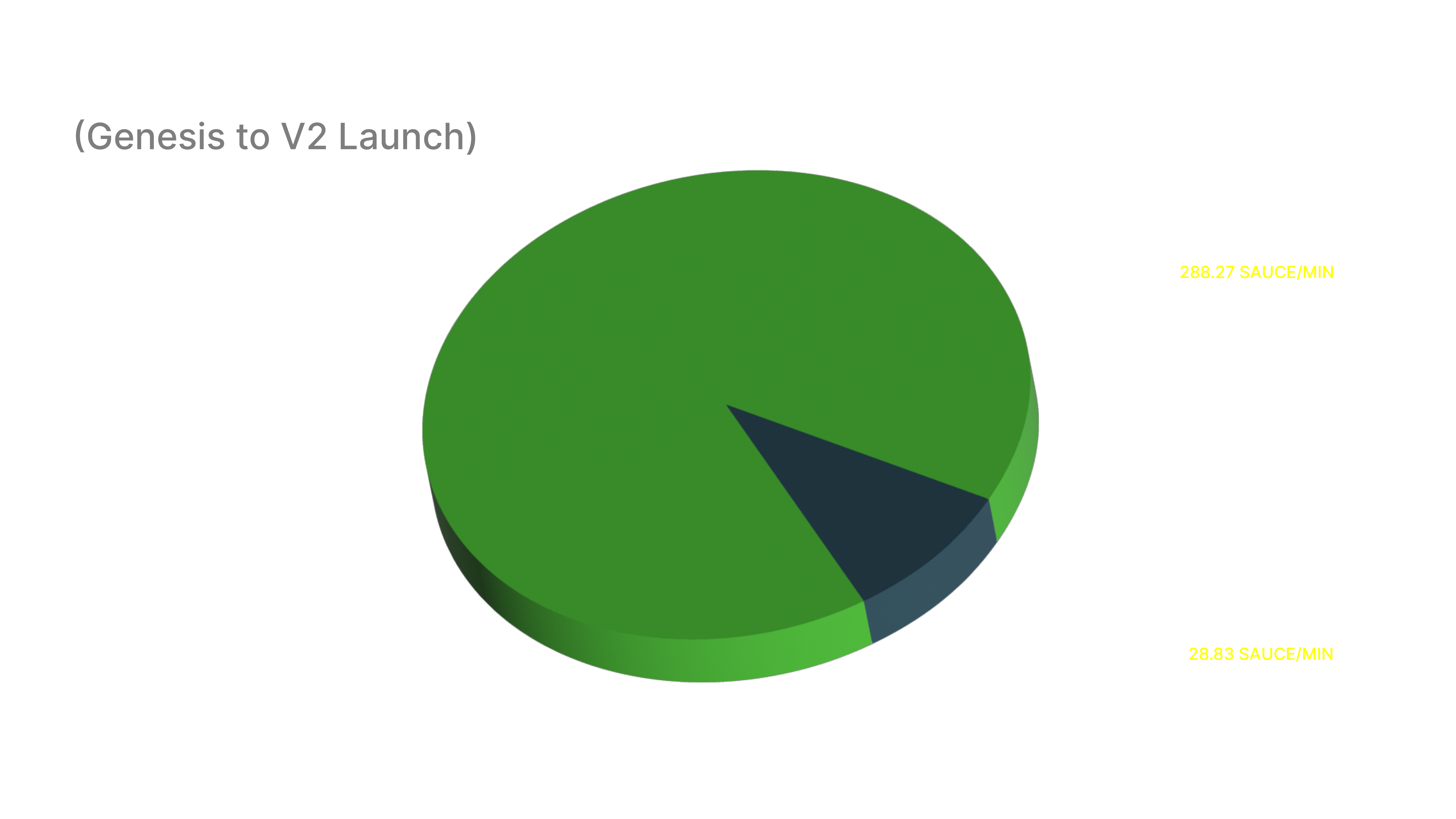

- Genesis to V2 Launch (Q3 2022 - Q4 2023):

- Yield Farm: 90.91%

- Devcut: 9.09% (with 70% to the DAO and 30% allocated for single-sided staking rewards)

- Emission Rate: 317.10 SAUCE per minute, giving a 3-year emission runway from genesis.

| Category | Masterchef Allocation | Emission Rate (SAUCE / min) |

|---|---|---|

| Yield Farm | 90.91% | 288.27 |

| Devcut | 9.09% | 28.83 |

| Total | 100.00% | 317.10 |

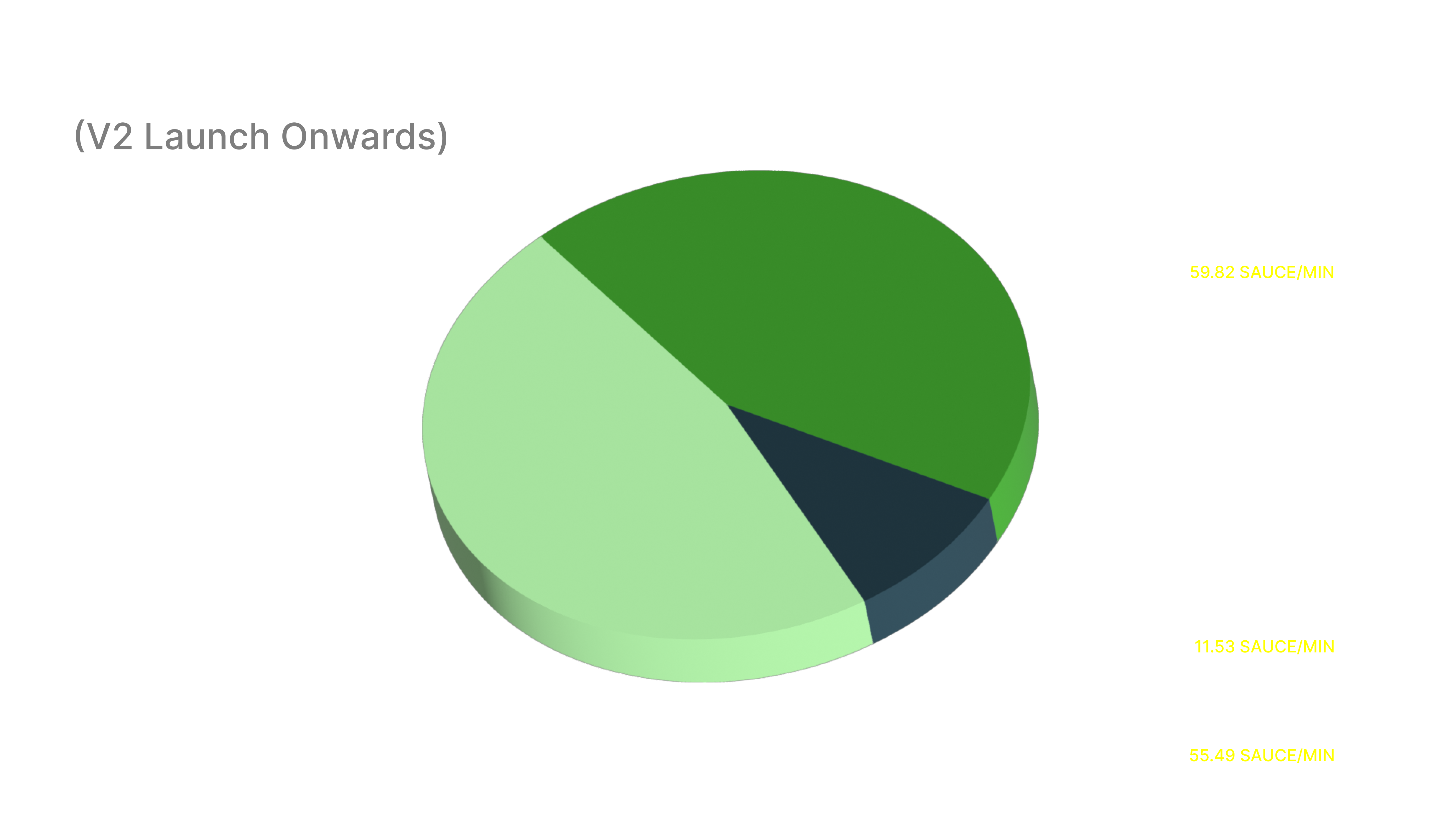

- V2 Launch Onwards (Q4 2023 - Q4 2028):

- Yield Farm: 47.16%

- DAO: 43.75% (with 50% retained by the operations multi-sig and 50% channeled to LARI rewards)

- Devcut: 9.09% (with 70% to the DAO and 30% reserved for single-sided staking rewards)

- Emission Rate: 126.84 SAUCE per minute, extending the emission runway to 6 years from genesis and marking a 60% reduction in inflation.

| Category | Masterchef Allocation | Emission Rate (SAUCE / min) |

|---|---|---|

| Yield Farm | 47.16% | 59.82 |

| DAO + LARI | 43.75% | 55.49 |

| Devcut | 9.09% | 11.53 |

| Total | 100.00% | 126.84 |

Summary

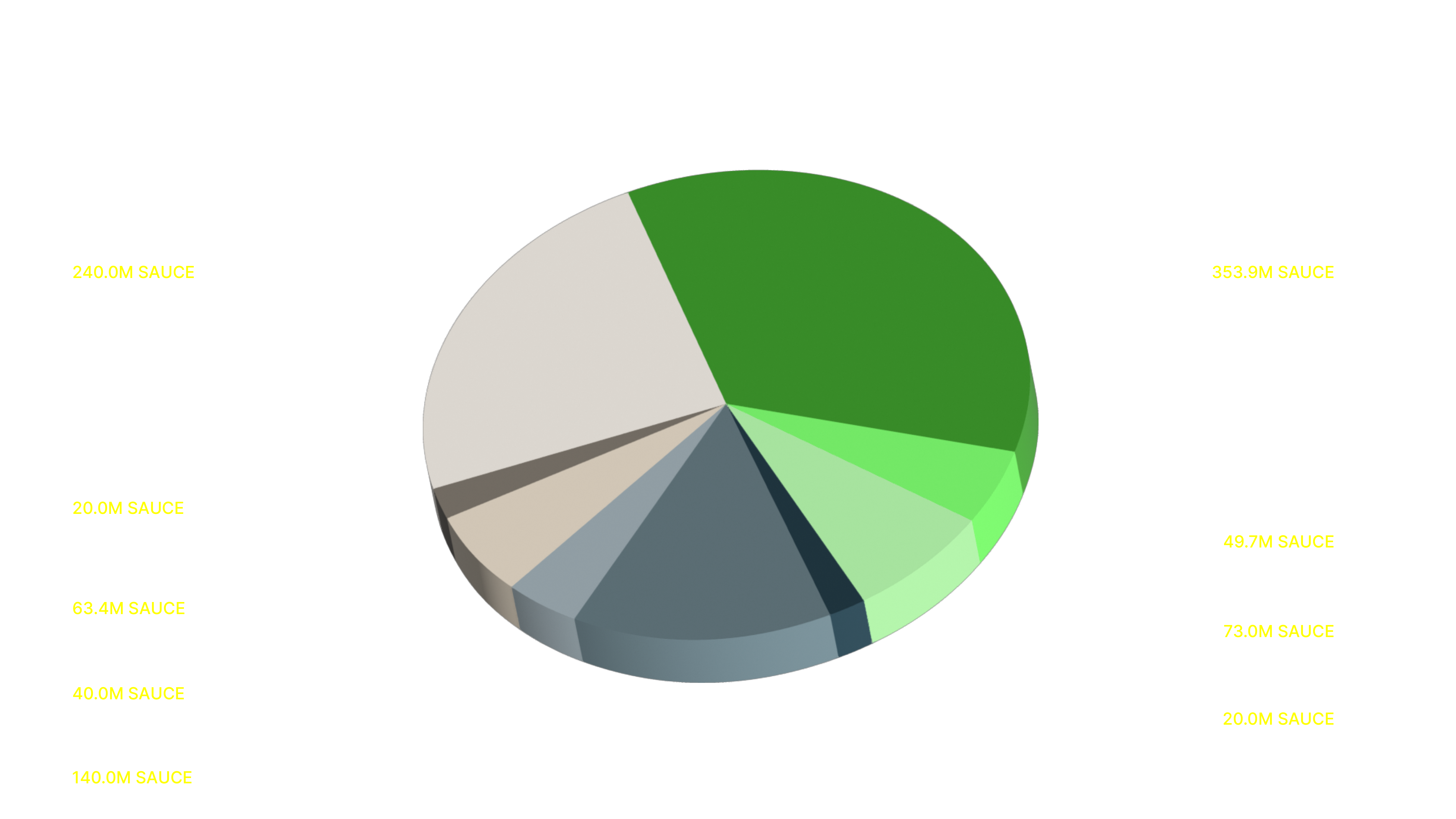

Below is a high-level summary of the updated tokenomics model, which takes into account two key assumptions: (i) the transition to V2 is set for November 15, 2023, and (ii) after the initial bootstrapping phase (epochs 1-4), half of the DAO’s share of Masterchef emissions will be directed to LARI.| Category | Number of Tokens | % of Max Supply |

|---|---|---|

| Liquidity | 20.0 million | 2.00% |

| Community | 140.0 million | 14.00% |

| Marketing | 40.0 million | 4.00% |

| Operations | 63.4 million | 6.34% |

| Advisor | 20.0 million | 2.00% |

| Core Development | 240.0 million | 24.00% |

| Yield Farm | 353.9 million | 35.39% |

| Devcut | 49.7 million | 4.97% |

| LARI | 73.0 million | 7.30% |

| Total | 1.0 billion | 100.00% |